What is a data feed? #

A data feed is simply the flow of data from an exchange that contains the current pricing data. Data feeds can be real-time or delayed. Having the appropriate data feed for your trading style is critical, as the tools give the best results when provided with timely and accurate data. This is one area of trading where the old adage – ‘garbage in – garbage out’ is extremely accurate.

The free version of Trading View comes with a free CBOE BXZ data feed (formerly known as BATs exchange). This data feed will generally give you accurate prices for big cap/high volume stocks during regular trading hours (9:30am – 4pm ET). This exchange handles about 10% of the daily market volume and is notorious for having bad and/or missing pre/post market data. You can easily identify when you are on this data feed by the two red squiggly lines after the ticker description line in the upper right of each chart. Delayed data feeds can also be identified in the same location by the orange D following the ticker description.

| CBOE BXZ Data Feed | Delayed Data Feed |

|---|---|

Picture of CBOE BXZ data feed |

Picture of delayed data

|

For more information on why the CBOE BXZ data prices differ from the official exchange traded data feeds read the following Trading View article: Why might my US stock data look incorrect?

In addition to the free CBOE BXZ data feed, Trading View also carries the CME Group’s futures data (ES, NQ, CL, etc.) that is delayed by 10 minutes for free.

# Which datafeeds do I need? #

For those of you trading intraday or short-term swing trades, we strongly recommend that you purchase the exchange data feed that covers the instruments that you trade in. You will need a paid Trading View account to purchase exchange data feeds due to exchanges rules.

A typical recommended data feed setup for a daytrader covering majority of the US Markets would include the following data feeds:

| Arca – NYSE Arca | $3/month |

| CME Group (E-Mini Included) – CME, CBOT, COMEX, NYMEX | $5/month |

| NASDAQ – NASDAQ Stock Market | $3/month |

| NYSE – New York Stock Exchange | $3/month |

If you want to trade OTC/Pink Sheets stocks – also known as penny stocks – you would need to add the “OTC” data feed to the list of required data feeds. The OTC Market provides Trading View with a free 15 minute delayed data feed, so you can get away with not having the real-time data feed, while still having access to the delayed price data.

| OTC – OTC Markets | $3/month |

# How much a month are they? #

The recommended data feeds currently cost a total of approximately $14 per month above and beyond the monthly pricing for your Trading View subscription as of November 2022. Trading View passes through the cost of the data feeds from the exchanges without any markup and collects taxes only if they are required.

You can always find the most current information on the availability and pricing of the data feeds here: Trading View data feed pricing

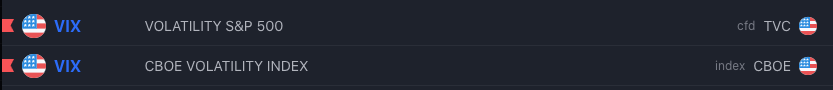

# What about a VIX datafeed? #

CBOE does not yet provide Trading View with a real-time data feed of its VIX index – only delayed. Trading View has publicly stated that they are in the process of trying obtain access to the CBOE VIX data feed but have not yet been successful.

Trading View’s CBOE VIX availablity

Picture of CBOE VIX Data availability

CBOE VIX Delayed Data

![]()

Picture of CBOE VIX Delayed Data

In the meantime, Trading View provides a workaround to this issue by offering an unofficial in-house real-time data feed that closely mimics the actual CBOE real-time VIX calculations. The ticker symbol is “VIX – Volatility S&P 500“ on the TVC exchange.

Trading View’s Ticker symbol – note the cfd TVC exchange

Picture of TVC’s real-time VIX symbol

Trading View Company (TVC) Real-time VIX alternative

![]()

Picture of TVC’s real-time VIX alternative

The symbol status line will look like the image above when the correct version of VIX is selected.

# What about Crypto data feeds? #

Crypto data feeds are handled differently. Each exchange (Coinbase, BitStamp, Binance, etc.) provides Trading View with its own free real-time data feed and historical data set for the cryptos traded on their exchange. As a result, you don’t need a paid data feed for trading cryptos in real-time.

The tradeoff is that there is no NBBO (National Best Bid Offer) equivalent across all exchanges world-wide meaning that the prices can and do vary significantly from exchange to exchange. The amount of historical data available can also vary from exchange to exchange with some exchanges providing more historical data than others. If you have trouble with historical data on one exchange, consider switching to another exchange to see if that fixes the problem.

The critical thing to remember, is that you need to be watching the data feed of the exchange that you are buying and selling cryptos on. Otherwise, it is likely that you will make mistakes translating the pricing from one exchange to another in the heat of the trade.